This move is notable because the whale previously earned $200 million by shorting the market during the October 10th crash. The recent closure of ETH positions raises questions about the market’s future direction, especially as the U.S. government shutdown continues to create uncertainty.

This action has prompted analysts and traders to reconsider their positions on Ethereum. With market sentiment showing signs of fear, as reflected by the Fear and Greed Index dropping to 27.

Many are questioning whether the whale’s decision signals upcoming price declines or if it’s simply a cautious move ahead of potential market changes.

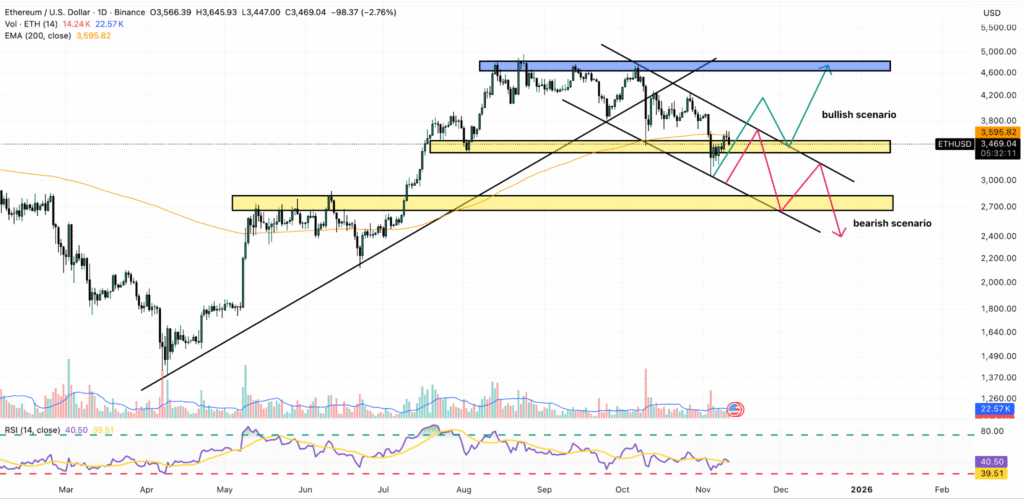

Potential Bullish and Bearish Scenarios for ETH

Ethereum’s future price movement could go in one of two directions, depending on how the broader market reacts to key developments, particularly the U.S. shutdown situation. A bullish scenario would see Ethereum breaking out of its current downward trend.

Such a breakout could push ETH toward the $4,000 mark, potentially surpassing it if strong buying momentum takes over. This could mark the beginning of a new upward trend in the market.

On the other hand, a bearish scenario remains plausible if Ethereum continues on its current trajectory. The token could fall to $2,700, a 23% decline from its current position. This would suggest that short-sellers may gain the upper hand unless significant positive news or changes occur.

Market Sentiment and the Role of the U.S. Shutdown

With such a backdrop, the Hyperunit whale’s decision to liquidate its ETH positions could reflect concerns about potential market weakness in the short term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.